Founded in 2009 by a small group of scientists and technology experts led by Misha Malyshev, Teza began life as a private high‑frequency trading shop driven by curiosity and a passion for solving hard problems.

After Citadel, Dr. Malyshev built a new HFT business from scratch. Teza solely ran internal money from 2009 to 2015. HFT Sharpe ratios ranged from 10-20.

We built one of the fastest low-latency execution systems, a key driver of early success.

Teza began extending its pursuit of alpha beyond high-frequency trading, applying its scientific rigor to longer-horizon signals. Following years of intensive R&D and encouraging results, the team set out to build a quantitative hedge fund tailored for institutional investors.

This marked the beginning of Teza’s transformation into a multi-strategy quantitative firm.

While the firm sold its HFT business, it retained the infrastructure, datasets, and deep technical expertise that powered its early success.

Market microstructure trading remains central, with growing use of alternative data.

Teza’s proprietary research had uncovered an edge in microstructure signals. This led to the launch of a new multi-strategy platform, anchored by these signals and enhanced by market impact models. As the asset management business grew, so did Teza’s reach, currently covering: global futures, equity stat arb, and options.

Teza continued to expand its multi-strategy investment platform, with active strategies across global futures, equities, and options. As part of this growth, the firm deepened its presence in global equity markets and extended its capabilities in options trading.

Our edge comes from a team DNA driven to question, experiment, and create

Teza is led by a seven-person leadership team that brings deep expertise across investment, technology, and operations. Many of us know each other and have worked together for over a decade, building a culture of trust, intellectual honesty, and data-driven decision-making.

Dr. Malyshev earned his Ph.D. in Astrophysics from Princeton University in 1998, after completing an M.S. in Theoretical Physics and a B.S. summa cum laude in Physics and Mathematics at the Moscow Institute of Physics and Technology.

Early in his career, he conducted hands‑on research at Bell Labs until 2000, refining experimental methods and fostering a culture of inquiry.

From 2000 through early 2003, he served as a consultant with McKinsey & Company, where he honed his ability to translate complex scientific and mathematical concepts into actionable strategies for asset managers and investment banks.

In April 2003, Dr. Malyshev joined Citadel’s strategy group, and a year later moved into its Quantitative Analytics division to build and lead their High‑Frequency Trading business. Rapid promotions followed – first to Managing Director, then Global Head of HFT – positions he held until departing in 2009 to launch Teza.

A committed advocate for STEM education, Dr. Malyshev partners with organizations that inspire young people to pursue careers in science, technology, engineering, and mathematics. His leadership blends academic rigor, industry experience, and a hands‑on passion for discovery – qualities that continue to shape Teza’s culture of innovation.

Chief Technology Officer

Steve Lazzo leads the technology teams for trading, data, and infrastructure. He joined Teza in 2023 as Vice President of Engineering. Prior to joining Teza, Steve spent eight years at Allston Trading both as Chief Technology Officer and Chief Information Officer. He led the software development, infrastructure, and operations teams. At Allston, he developed an ultra-low latency futures trading platform, a compute cluster, and a revised data management system.

Previously, he was at Citadel LLC for 10 years serving as both a manager and developer in the High Frequency Trading Group, the Statistical Arbitrage Team, and the Options Market Making Group. He was responsible for the technology team that built Citadel’s first HFT platform, and personally wrote their first algo trading engine and real-time position management system.

Before that, Steve spent 10 years at UBS AG as Director where he built systems for equity options trading, pricing, and risk management. Steve has a Master of Computer Science from the Illinois Institute of Technology and a B.S. in Biology from the University of Illinois at Urbana-Champaign.

Head of Risk

James Chavin joined Teza as President in 2022. He became Head of Risk in the summer of 2023. Prior to Teza, James spent 17 years at McKinsey, including eight as a Senior Partner, during which time he led McKinsey’s Restructuring and Transformation Practice in Europe, Middle East, Africa and Russia, during which time he served both creditors and debtors in Chapter 11 and out-of-court processes.

James is a Chartered Finance Analyst (CFA) and also spent seven years as analyst, portfolio manager and founding member of global macro, long and long-short funds. James has a Ph.D. in Political Science from University of California at Berkeley and an undergraduate degree in Political Science from Stanford University.

Chief Operating Officer

Prior to joining Teza as Chief Operating Officer in January 2023, Tanya founded Particle.One in 2019 to conduct AI assisted commodities research. Using knowledge graph methodology and natural language processing, her team identified relationships between company data and commodities, enabling commodity producers to find alpha in proprietary datasets.

Since 2021 Tanya also worked with Teza as an independent consultant. She has been instrumental in the firm’s exposure into the digital assets space as well as expanding our global footprint. She is active within the fintech community – asset management, banking, startups and VCs, serving as an Advisor, Judge and Lecturer at Alchemist Accelerator.

She began her career as a team growth consultant. In 2012 Tanya started her own boutique consulting business that grew to 30+ employees and was sold in 2018 to a competitor. Her clients included Deutsche Bank, Credit Suisse, Merrill Lynch and others.

Tanya graduated from Moscow State University with a degree in Applied Mathematics and Quantum Physics.

General Counsel & Chief Compliance Officer

Brandon Johnson joined Teza as General Counsel and Chief Compliance Officer in December 2021. Prior to joining Teza, Brandon served as the General Counsel at Belvedere Trading LLC, a broker-dealer based in Chicago, for over three years handling all legal matters and advising on regulatory examinations and inquiries.

Before serving as General Counsel at Belvedere, Brandon was a principal consultant with Titan Regulation advising a number of RIA/CPO/CTA/Broker-Dealer clients on all regulatory matters and investigations. Brandon got his start in financial services working as a compliance officer and junior attorney for CTC Trading Group in Chicago. Brandon earned his J.D. at IIT Chicago-Kent College of Law and has a B.A. in History from the University of Illinois Urbana-Champaign.

Head of Business Development

Joel McAndrew joined Teza as Head of Business Development in January 2022. Joel has over 17 years of experience in hedge fund marketing and sales. Prior to joining Teza, Joel was a Partner and served on the Management Committee of Versor Investments, a quantitative hedge fund based in NY. Prior to Versor, Joel was Head of Institutional Sales for Gotham Asset Management, a value-oriented investment firm based in New York City founded by Joel Greenblatt.

Joel began his career at D.E. Shaw, a quantitative hedge fund, where he was an Associate on the Investor Relations team. He was also an inaugural member of their institutional asset management business (130/30 and long-only equity strategies) where he helped launch the new platform and headed client service. Joel attended Carnegie Mellon University and has a B.A. in Piano Performance.

Head of Finance

Taco Sieburgh joined Teza in November 2023, bringing over 30 years of experience in finance, corporate operations, and research. He has held leadership roles across multiple regions, including Singapore, New York, and London, and has extensive expertise in hedge fund management, research, and corporate finance activities.

Taco is a Chartered Financial Analyst (CFA) and holds an MBA from the University of Chicago as well as a Business Economics degree from Erasmus University in Rotterdam. Originally from the Netherlands, he speaks five languages and has worked extensively across Asia, Europe, and North America.

Everything we build at Teza – every model, system, or idea – starts with people. We hire for exceptional thinking, deep curiosity, and the ability to work across disciplines. Our success isn’t the product of process or hierarchy. It comes from small, high-performing teams working with clarity, speed, and trust.

We value people who think independently and work collaboratively. The ones who don’t just spot opportunities, but take ownership in pursuing them. And we give them the room to do their best work no micromanagement, no bureaucracy, no politics.

We use a simple formula to guide hiring decisions.

It’s a real formula, not a metaphor. Each component is essential. If any are missing, the outcome is zero. But when all are present – especially Drive – the potential grows exponentially.

KEY ELEMENT

Success = step(IQ) × step(IT) × step(HR) × exp(Drive)

IQ is Fast Thinking

It’s the ability to absorb complexity, reason quickly, and adapt. What that looks like depends on the role, but the core is always the same: how quickly someone can understand, decide, and react.

IT Is Technical Fluency

Most people at Teza write code, whether they’re building infrastructure, researching markets, or working in operations. The bar depends on the role: higher for developers than researchers, for example, but everyone is expected to understand and work with technology. It could be C++ or Java, Python, automation in Excel, or integrating of external tools. This capability is foundational across the firm.

HR Is How Someone Works with Others

It includes communication, professionalism, and the ability to build trust across teams. Collaboration isn’t a nice-to-have – it’s essential.

Drive Is What Powers It All

It’s not about ideas or ambition: it’s about execution. People with Drive go beyond their job description. They take ownership, move fast, and make things real. It’s the only component in the formula that grows exponentially, and it’s the one we value most.

Talent isn’t magic. It’s a function

This formula helps us make consistent, high-conviction hiring decisions – and build an environment where exceptional people can do their best work

We’ve studied what makes teams effective at Teza, and we’ve built around it. High-performing teams here share ten traits:

These are not slogans. They’re operational principles we practice in everything from hiring and onboarding to feedback and planning. When teams embody these traits, they move faster, make better decisions, and deliver better outcomes with less friction and more trust.

with the highest ethical and legal standards, not just because it protects our reputation, but because it’s the right way to build a lasting firm.

about the spirit of the law, not just the letter.

transparently, take responsibility when things go wrong, and act in the long-term interest of our people, partners, and the public.

our teams to make ethical decisions under pressure, and we hold ourselves accountable to those standards at every level. No shortcuts, no exceptions.

Our expansion into Armenia reflects what we value: integrity, depth of talent, and long-term thinking.

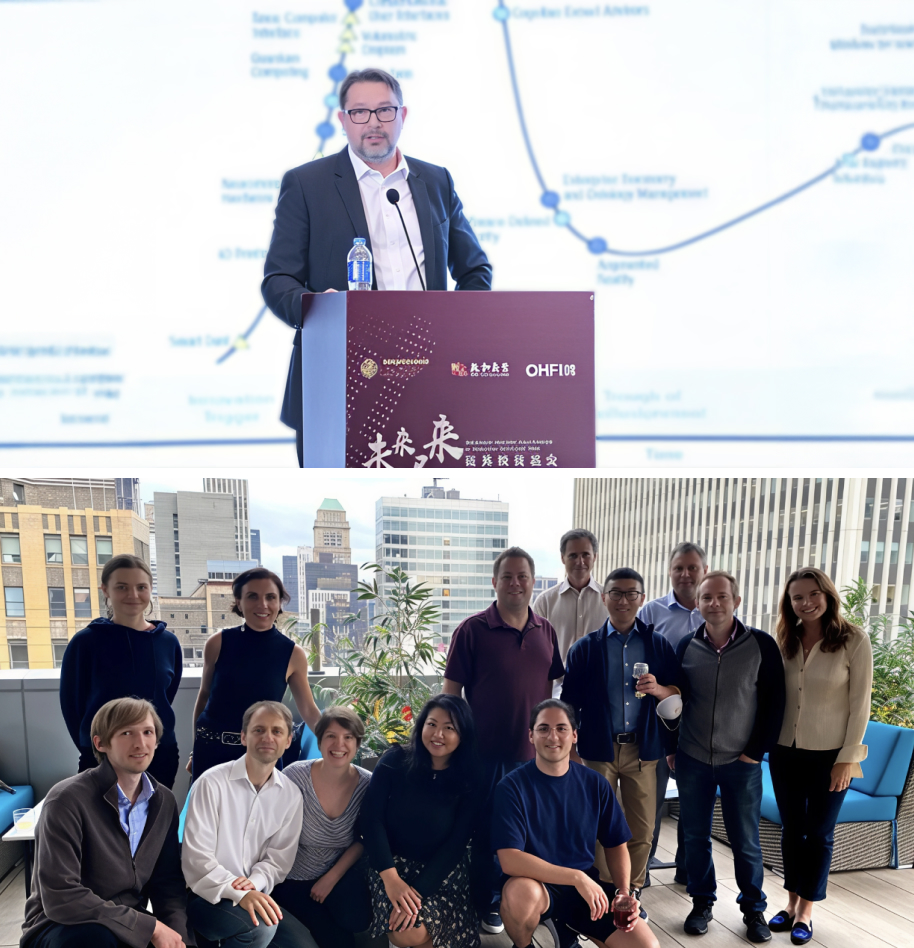

At Teza, we operate as a single team distributed across the globe. Most of the time, that means working with speed and focus across time zones and functions. But we also believe that some conversations – and some decisions – are best made face to face.

Each year, we host two anchor events that bring the firm together and help shape what comes next.

The Summer Work Together Week gathers a curated group of researchers, portfolio managers, and invited guests for deep discussions on strategy, markets, and innovation. It’s a focused space to challenge assumptions and explore new ideas.

Alps Work Together Week

January, 2026 | Swiss Alps, Champery

Work-Together Week

Jul 20 - 26, 2025 | Amsterdam, The Netherlands

TCM Conference 2024

Dec 6 - 9, 2024 | Paris, France

A Year Celebrated in Style!

Dec 2, 2023 | Yerevan, Armenia

Journey to the Stars

Dec 1, 2023 | Yerevan, Armenia

TCM Conference 2023

Nov 30 - Dec 1, 2023 | Yerevan, Armenia

The Teza Capital Management Year-End Conference is our internal summit. It’s where we reflect, share progress, debate priorities, and reconnect as a firm. It blends research, planning, and real conversations – the kind that are hard to have over Zoom.

In a distributed company, these moments are not optional. They’re how we stay aligned, sharp, and moving forward: together.

This Website Uses Cookies

This website stores data such as cookies to enable essential site functionality, as well as marketing, personalization, and analytics. By remaining on this website you indicate your consent.